8 min read

Since the initial lockdown the Government has introduced measures to protect commercial tenants from enforcement action in relation to unpaid rent. Our previous briefing considered the effect of these measures on the availability of landlord remedies. With tenant protections currently due to expire on 30 June 2021, this briefing considers what might happen next.

Protections for commercial tenants

Since March 2020, landlords of commercial property have been subject to statutory restrictions on their ability to recover rent arrears from their tenants. Three important protections are:

- a moratorium on forfeiting leases for rent arrears;

- restrictions on the use of the commercial rent arrears recovery (“CRAR”) process; and

- a prohibition on issuing winding up petitions or statutory demands for debts resulting from the COVID-19 pandemic.

These protections are due to end 30 June 2021. It has been reported that the Government will not extend financial support for businesses, despite the postponement of “Freedom Day”, but other measures are still being considered.

The Government has also published a voluntary Code of Practice for commercial leases. The stated purpose of the Code is to reinforce and promote good practice between landlords and tenants as they deal with income shocks caused by the pandemic. The Government is clear that tenants who are able to pay their rent in full should do so. But the Code supports others in agreeing arrangements for paying off and writing off rent debts by 30 June 2021.

Effect of the protections and Code of Practice

The British Property Federation (“BPF”) estimates that there will be around £7.5bn of commercial rent in the UK in arrears by the end of June. Around half of this amount is estimated to be from the retail sector.

However, the majority of commercial tenants and landlords have reached rental agreements. Estimates of the proportion of businesses that have reached agreement on rental arrears range from 60 – 90%, depending on the data and sector. This leaves a significant minority who either have not yet been able to reach an agreement or where one party is refusing to engage.

The Government consultation

The Government’s consultation on what should happen when the current restrictions placed on landlords come to an end closed on 4 May 2021.

The Government is considering six options:

- simply allowing these measures to expire on 30 June 2021;

- allowing the moratorium on commercial lease forfeiture to lapse on 30 June 2021 but retaining the insolvency measures and the protection from CRAR for a period of time;

- targeting existing measures to businesses based on the impact that COVID-19 restrictions have had on those businesses for a limited period of time;

- encouraging increased formal mediation between landlords and tenants;

- non-binding adjudication between landlords and tenants; and

- binding non-judicial adjudication between landlords and tenants.

The Government has not announced when it will release the results of the consultation, but several bodies have already published their responses.

Proposals for continuing protections

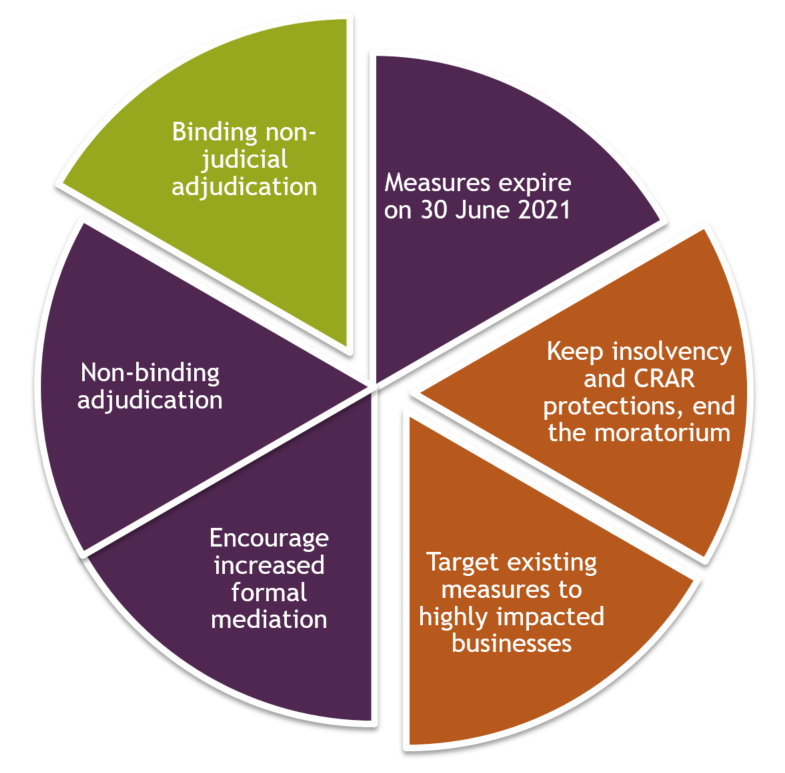

The diagram below shows the options proposed by the Government which appear to have had the most support across industry bodies based on published responses.

There is significant support for the introduction of binding arbitration. There is also support for a continuation of at least some of the existing tenant protections.

Continuing protections for commercial tenants

There are different views on the level of protection that should continue to be available to commercial tenants.

On the one hand, some bodies want all protections to remain in place for businesses that have been significantly affected by COVID-19 restrictions. For example, UKHospitality proposes that protections should remain in place for a further six months for sectors affected by closures. UKHospitality suggests that this will allow time for tenants and landlords to conclude agreements, establish the nature of the economic recovery and ascertain what restrictions should remain in place.

On the other hand, some suggest that there is little or no need for ongoing tenant protections. The BPF proposes that the moratorium be lifted in full at the end of June with negotiations between tenants and landlords aided by an enhanced Code of Practice.

Many proposals suggest a phasing out of protections. British Land, Land Securities and British Retail Consortium (“BRC”) all agree that commercial tenants should pay rent from the end of June as they resume trading. However, in order to protect tenants, payments owed from before the end of June could be ring-fenced with the moratorium remaining in place with respect to those arrears. These protections would continue until December 2021 to give landlords and tenants time to agree concessions where appropriate. These bodies also agree that the insolvency measures and CRAR protections should continue, although BRC propose these protections be extended to protect tenants from County Court Judgements.

Binding non-judicial arbitration

There is substantial support for the introduction of binding arbitration for parties that cannot come to an agreement on rent. However, the proposals of various representative bodies differ in how they suggest arbitration should work.

The majority of the proposals (including British Land, Land Securities, BRC and BPF) suggest that the decisions should be made by the arbitrators on a case-by-case basis, using principles set out in an enhanced Code of Practice as a basis. These bodies see arbitration as a last resort, intended to operate as a punitive measure to encourage tenants and landlords to negotiate in good faith.

However, UKHosptiality has stated that this would be impractical and unworkable due to the cost, length of time required and lack of expertise. UKHospitality proposes that the Government should decide at a national level the proportion of rent that is written off. UKHospitality proposes that at least 50% of rent debt should be written off for periods where businesses were forced to close and 25% for periods when restrictions are in place.

A blanket write-off of a proportion of debt is resisted by landlords and landlord representative bodies. British Land and Land Securities suggest that such a solution would penalise tenants who have paid rent throughout the pandemic and reward tenants who have abused the scheme by not paying rent despite being well-capitalised.

Key differences between proposals

The divergence between the various bodies’ proposals on what should happen after the 30 June 2021 appears to be driven by differences in market optimism and the extent to which the bodies sympathise with the commercial landlords.

Market optimism

Proposals from tenant representative bodies tend to emphasise the danger commercial tenants would be in if restrictions ended suddenly on the 30 June 2021. For example, the BRC, in a letter to Robert Jenrick MP, stated: “The worst outcome of all would be a ‘cliff edge’ on 1 July when all tenant protections are suddenly withdrawn with nothing to replace them. This would result in a mass of landlord rent recovery action which would almost certainly cause many businesses to enter a CVA or administration, threatening tens of thousands of jobs.”

On the other hand, landlords and landlord representative bodies have emphasised that it is not in landlords’ interests to let businesses fail and so they will look to find pragmatic solutions. The BPF predicts that the market will settle without the need for Government intervention as landlords and tenants will come to their own agreements. The BPF notes that, in a number of other countries where no moratoria are in place, the market is performing this function without widespread tenant evictions being seen and with concessions being provided to tenants who need them.

Sympathy with the commercial landlords

The tenant representative bodies emphasise the difficult period the commercial tenants have had. UKHospitality notes that: “there is a moral obligation on landlords... to make rent concessions to businesses forced to close” and that there must be a “sharing of the pain caused by Government closures and restrictions”.

However, landlords and landlord representative bodies point out that it is not just the tenants who have suffered financially. They note that there are some tenants who are abusing this scheme, not paying rent despite being well capitalised. The BPF’s published response notes that many property owners urgently need to restore an income stream in order to satisfy their lenders’ mortgage requirements as well as to be able to invest in their existing properties and new development. The BPF points out that many smaller property owners rely on rental income which they may not have had for over a year.

That said, UK Finance has published a statement that its members will continue to support commercial landlords including amendments to facilities and capital payment holidays even though no formal measures have been introduced by the government.

Conclusion

As “Freedom Day” is postponed to July, pressure on the Government to extend tenant protections shows no sign of going away. The Government continues to face the difficult task of balancing protection of tenant businesses – particularly retail businesses – against the interests of landlords and the economic reality of a growing rental debt pile. Whatever the detail of any extended protections, it is clear that a focus on cooperation between landlords and tenants to reach pragmatic agreements is here to stay.

This material is provided for general information only. It does not constitute legal or other professional advice.